The power of behavioral economics in hotel pricing

It was really a first, actually two firsts… having a professor running a workshop during the Hotel Revenue Forum as part of the Global Revenue Forum and being able to gather so many (Italian) revenue managers and commercial directors in a room to discuss pricing strategies and share knowledge never happened before!

Thanks to Prof. Kai-Markus Mueller a consumer neuroscientist, author of the award-winning book “The Invisible Game – The Secrets and the Science of Winning Minds and Winning Deals“, and co-host Chris Crowley, Duetto’s Chief Revenue Officer, the session was a great success; pity that it only lasted 90 minutes!

Following the morning keynote speech, in the afternoon workshop, Prof. Kai-Markus Mueller kindly introduced us to behavioral economics, the field that combines several disciplines like psychology, neuroscience, and sociology to study how we make economic decisions. The discipline questions the assumption that we always make rational decisions and scientifically proves that cognitive biases, emotions, and social influences play a crucial role when making economic decisions.

While it is nothing new, it always surprises me how quickly we tend to forget the basic concepts and how knowing these concepts might help us in succeeding in business and making better (personal) economic decisions when buying a product or a service.

That pricing and how we can influence the decision-making process passionate revenue managers and commercial directors was clear from the very first slide Prof. Kai-Markus Mueller showed which ignited a great and long interactive discussion with many questions and examples.

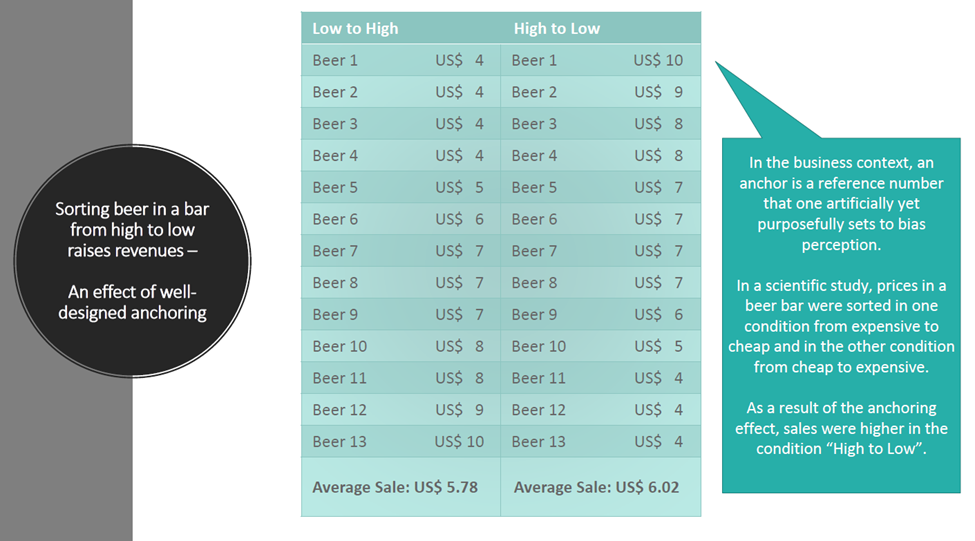

The first slide was about the order in which products are displayed, regardless of the product itself. The example Prof. Kai Markus Mueller discussed was linked to the way beers were sorted and offered at a pub, for example with rates from “high to low” and the opposite, from “low to high”. After several tests it appeared that the average rate of beer sold was higher when beers were offered on a “high to low” rank.

Here follows the visual:

This is a universal concept meaning that it is cross-cultural because it is based on hardwired brain mechanisms that come into play regardless of where we live and where we grew up. This is because our human brain works in a relative manner, meaning that whatever we see (hear) first has a strong influence on what we see (hear) subsequently.

So “what is in it for me” as hotelier? Well, you only need to replace “beers” with “room types” and “pub” with “web” and the same principle can be applied.

The way in which we decide to display our room types and our rates should be linked to the well-known cognitive bias called “anchoring”. In a business context, “an anchor is a reference number that someone artificially yet purposefully sets to bias perception. Anchors constitute the reference set of information – usually numbers – that allows someone to quantify and scale a relative relationship (hot versus cold, heavy versus light, important versus unimportant). In that way, anchors facilitate decision making” *.

For our purpose we could identify two levels of “anchoring”: a macro one (overall display rank of room types on the web for example) and a micro one (different price points per room type, like Room Only, Package, Special Offer etc.). Essentially, the first element / price we see on any screen will have a strong influence on the other elements / prices you will see later.

If you start by offering the cheapest option, let’s say your “standard” room type or your cheapest rate, selling “premium” room types like suites or “added value” rates might result in a challenge because they might seem too expensive.

But does all of this work when we take into account our competitive landscape and how online distribution interfaces are designed to display rates? A comment was raised about the risk of appearing out of the market if we decide to display “high to low” or at least not “low to high” and about the big challenge to display a different order than “low to high” in on-line distributors where the main (sometime only) objective is to convert.

We know how much we can be obsessed with our competitors however it was clearly highlighted that the first competitor is yourself. Often too much weight is put on our competitors forgetting to look first at ourselves. Remember: competitors might have a completely different cost structure which influences their rates. Similarly, when talking about the distribution landscape, it was highlighted that we should never lose control on our rates and inventory, when distributing online.

Having said that, what other pricing strategies can we leverage to face our competitors and our distribution landscape?

Next to “anchoring”, “framing” in another key pricing strategy. “Framing” pricing strategy emphasizes different aspects of value to highlight the benefits and the advantages, rather than just the cost. Value pricing is the best way to win the competition and to respond to the potential adversity by on-line distributors to show rates in a different way than “low to high”.

However, there are plenty of strategies and models available to make your pricing much more effective.

“Decoy” pricing is part of how you “frame” your pricing: “decoy” is how to present a third option that is less attractive and more expensive than the other two options, making one of the other options seem like a better value. Next to “decoy”, “cost of zero” is another framing technique: “free” causes travelers to forget the downsize of a purchase because it positions value against inclusion rather than price.

The objective is always the same: how to drive consumer buying decision to what you want. As Prof. Kai-Markus Mueller explains: “Decoys can affect choices in several ways. The irony of decoys is that you can strengthen your portfolio – and boost your sales – by including a product nobody wants to buy” **; while Prof. Mueller is referring to sales this technique perfectly applies also to revenue management, showing once again how much revenue managers can absorb from sales and how strong the link between sales and revenue management is.

At this point the following question was raised: does this mean that we should choose from one of the pricing strategies covered so far, all year round? Does one pricing strategy fit all times and scenarios?

To this question the answer was straightforward:

”No! In order to successfully apply consumer psychology, specific circumstances call for distinct pricing strategies.”

Some other effects and behaviors linked to pricing strategies were covered next:

| Effect / Behavior | Description |

| Status Quo Bias | refers to the tendency of consumers to continue purchasing a product at the same price, even if there are attractive alternatives; this is based on the assumption that the current price is the “normal” or “default” price for that product and any deviation is seen as an inconvenient need to actively make a new decision; a related example is the so-called “Endowment Effect”, which occurs when you show people what is in an offer and they don’t want to give that up anymore by downgrading to a different offer. |

| Hot vs Cold States | emotions do affect our decision-making meaning that decisions made under stress (“hot states”) are more irrational than those made in “cold states”, e.g., well-planned in advance; this might play a big role when booking or thinking about the respective booking window; such considerations play an important role in the Time to Value pricing model. |

| Loss Aversion | as strange as it might sound, for humans it is more important to avoid losses than it is for them to realize gains… |

| Priming | this happens when the decision process is influenced in advance at critical moments to steer the behavior in a desired direction. |

| Bandwagon Effect | this effect can influence customers to make purchasing decisions based on the perceived popularity or acceptance of a particular price point or pricing strategy; it is “follow the crowd” effect, for example if a product is priced at premium, customers are more willing to pay that price if they believe that others are also willing to pay for it… this is because they may view the premium price as a sign of quality or exclusivity and they might want to be part of a perceived elite group that is able to afford that product; the opposite is also applicable: customers might be willing to pay a cheaper price if they believe that others are also going for that option; they might want to be part of a group that is perceived to be savvy. |

We spent almost an hour to cover the above, linked to the only slide Prof. Mueller was able to show…

This is what I would call the “interactive” effect!

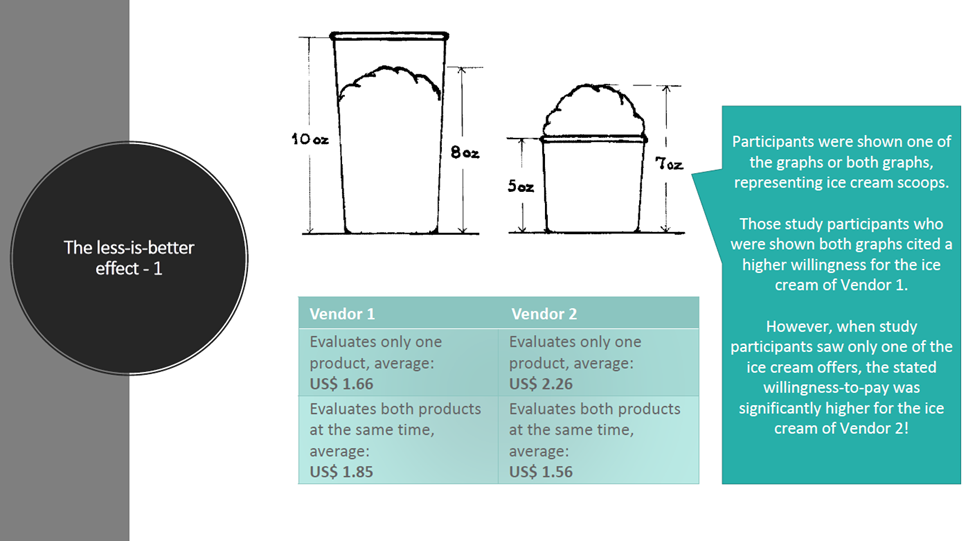

Time to move then to the second slide which was about the “less is better” effect.

This is the phenomenon where consumers perceive a smaller quantity of a product to be of a higher value than a larger quantity, even if the price per unit is lower.

To explain this effect Prof. Mueller used the ice cream example: “it would make sense for someone to pay more for a an eight-ounce serving of ice cream than a seven-ounce serving of exactly the same ice cream. But this is not true when the seven-ounce serving is crammed into a small container, while the eight-ounce serving comes in a ten-ounce cup that clearly leaves empty space at the top. The respondents in that study were willing to pay more for less”***.

Here follows the visual:

The beauty of the example is that it applies to all products and services, and it perfectly fits with our “total revenue management” approach, something that revenue managers have been trying to implement for many years.

To the question if techniques like “less-is-better” can be used to influence people judgements (in relation to reviews and reputation management), it was observed that people care essentially about three things:

- Looking good with their peers

- Getting good value

- Not missing out

Revenue is the best place to start inducing compulsion in people. And this applies not only to rooms but to all other revenue generating departments, from F&B to spa, golf etc.

It was clearly highlighted that very often we lack in proactivity in selling ancillary revenue, in upselling, in taking any possible way to sell incremental services and products. And this applies to any kind of hotels, from urban / city to resorts / countryside hotels, regardless of their primary business segments.

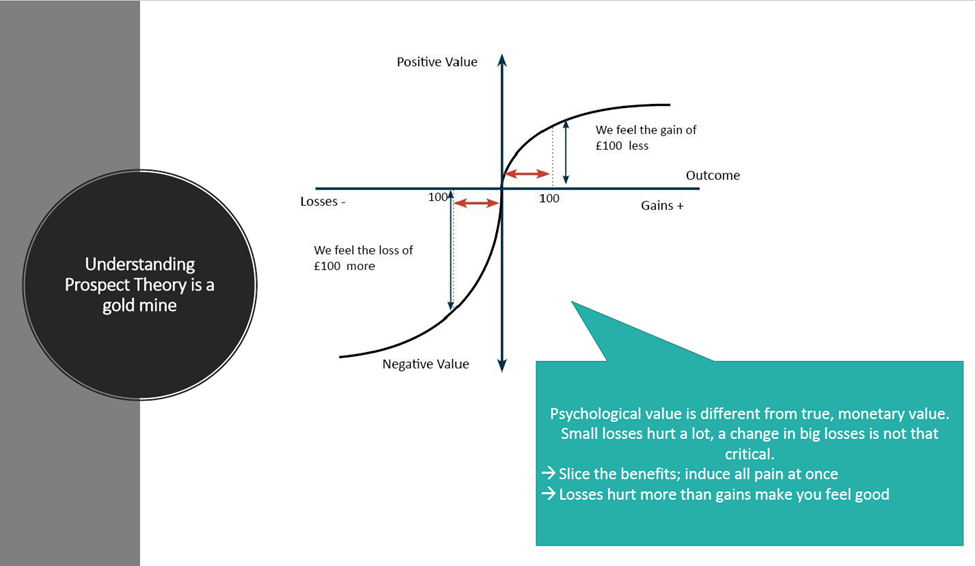

A lot of food for thought indeed especially in the area where revenue management, marketing, and sales converge. Time was ticking and unfortunately Prof. Mueller had to jump to his last slide, introducing “prospect theory”, a theory developed by Kahneman and Tversky and published in 1979.

The principle is that there is a (big) difference between psychological value and monetary value.

Let’s make it visual again:

The X-axis represents monetary value while the Y-axis illustrates psychological value. This might really sound crazy, however, why should 1 Euro be worth more or less than 1 Euro?

“Prospect theory (…) has three basic tenets:

- Small values in gains and losses have a disproportionately high psychological impact.

- High values in gains and losses have a disproportionately low psychological impact.

- People suffer from losses more than they enjoy gains” ****.

Looking at the graph, you will note that the value perception is not a straight line but more of an “S” shape. This is because while the first Euro makes us incredibly happy and so does the second and the third at a certain point one or more Euros do not make any difference; this is true for both positive and negative value perceptions.

One highly relevant additional implication: this function is asymmetric meaning that getting 5 Euros is different from losing 5 Euros… because loosing money hurts a lot more than gaining…

This also explains the “loss aversion” pricing concept we saw before: it is more important for people to avoid losses than it is for them to realize gains.

In this sense “freebies” are extremely effective: giving something for free and especially the “first Euro” make people extremely happy influencing their emotional status in a positive way.

During the discussion, it was pointed out that loyalty programs are built on some of the above behaviors and pricing effects.

Another interesting aspect that Prof. Mueller explained is related to the price increase and the best techniques to communicate it. Psychologically, it is recommended “to bring pain and perceived losses such as price increases in one go, so that your client can process pain quickly and move on” *****. This is a great insight when thinking about increasing prices to our corporate clients or following a refurbishment or simply when we want to increase prices overall.

Unfortunately, time was up, and 90 minutes really flew! Just a couple of minutes to sign everyone’s book copy which was handed out at the end of the workshop, and we had to say goodbye to our moderators.

To close the loop and thinking about the WIITFM (What Is In It For Me) here follow some takeaways:

- You might consider a different ranking in different period / season or even days of week.

- It does not need to be radical: low to high or high to low… based on your data you decide your “anchoring” rate type at macro level and your “anchoring” price at micro level, as long as you are open to test it and test it again.

- Next to anchoring, remember to keep an eye on how you “frame” your pricing and the “decoy” effect.

- Remember that these are universal principles and cross-cultural… meaning that they apply to hotels as well!

- Pricing principles apply to all revenue streams: put your total revenue management hat on and lead other revenue generating departments in thinking how they can influence consumer pricing decisions in their respective business areas like F&B, spa, golf, casino etc.

- Less-is-better: this effect is applicable to all revenue generating departments.

- Consider the difference between the psychological and monetary value of any product or service keeping in mind the “loss aversion” effect and that the first, small gain makes people the happiest.

- Generally speaking, human beings are reluctant to change; however, it is only by testing and thus changing that you will find the best solution; therefore, the invitation is to test and test again keeping in mind that changing is a never-ending process, meaning that what works today might now work tomorrow; in other words move and keep moving.

Thanks again Prof. Kai-Markus Mueller and Chris Crowley for their great contribution and to all revenue managers and commercial directors for making this session an extremely interactive one.

Global Revenue Forum will be back on January 30th 2024 in London, Milan and Stockholm. To stay tuned follow us.

To the next one!

*”Kai-Markus Mueller, Gabriele Rehbock, “The Invisible Game – the secrets and the science of winning minds and winning deals”, Wiley, 57.

**”Kai-Markus Mueller, Gabriele Rehbock, “The Invisible Game – the secrets and the science of winning minds and winning deals”, Wiley, 206.

***”Kai-Markus Mueller, Gabriele Rehbock, “The Invisible Game – the secrets and the science of winning minds and winning deals”, Wiley, 193.

****”Kai-Markus Mueller, Gabriele Rehbock, “The Invisible Game – the secrets and the science of winning minds and winning deals”, Wiley, 178.

*****”Kai-Markus Mueller, Gabriele Rehbock, “The Invisible Game – the secrets and the science of winning minds and winning deals”, Wiley, 181.